Jeffrey Kiesel | O: (610) 827-0130 | C: (610) 389-2140

Solid Rock Retirement

Tax-Free Retirement Accounts • Social Security Maximization/Planning

Alternative Retirement Planning • Protecting & Growing Your Retirement Nest Egg!

00

Years

00

Months

00

Weeks

00

Days

00

Hours

00

Minutes

00

Seconds

Money Strategies that Work

Achieve a level of financial independence most only dream of.

Disciplined Approach

Enjoy a substantial amount of retirement money through simple saving and spending plans.

Commitment to customer satisfaction

Know that your financial needs come first, and we take the time to get to know you!

"Efficiently protect and grow your retirement funds, so you can maximize the funding of your retirement dreams!"

I’m Jeff Kiesel.

“I help my clients get out of debt, put their home-equity to work earning positive returns, and create guaranteed income-tax-free retirement.”

My father and step-father both died young, but they had life insurance which enabled my six siblings and me to go to college.

I also developed a health issue that made me personally appreciate the value of the life benefits permanent life insurance, specifically Index Universal Life insurance, can offer.

Permanent life insurance is more predictable than real estate. You know you’re always going to have your money earning uninterrupted compounding interest.

There is also more of a guarantee with life insurance in terms of the returns you get. And most importantly, if you structure it correctly, you could enjoy leveraging the cash value of the policy as income-tax free income for emergencies, retirement, and nursing-care needs.

Take Control of Your Financial Future -

No Luck or Guesswork Required!

Free Download!

CLICK BELOW to download a free chapter of My Family Financial Miracle by my friend and colleague, Merle Gilley.

He’s helped thousands take control of their money, and you might find his ideas useful.

CUSTOM JAVASCRIPT / HTML

“An investment in knowledge pays the best interest.”

~ Benjamin Franklin

MONEY SCHOOL

Free Tips & 'How-To' Information

Updated every 1 to 3 weeks, this webinar series will provide you great insights into how money works.

Hosted by key industry leaders, you will learn helpful hints and little-known secrets on how to save, keep, grow, and protect your money.

Pause the video for more options and links to free downloads on the video topic.

Visit Often. Topics change regularly.

CUSTOM JAVASCRIPT / HTML

An Alternative Money Solution that Protects You and Your Family from Loss

I’m a devout Christian, and I work to ensure that people everywhere are treated fairly and with respect.

The life benefits of Index Universal Life insurance (IUL), empowers people. It is versatile: it can give the well of money necessary to provide for people in case of a loss. But it is also something that can be tapped into to provide for all of life’s emergencies: from disability to long-term care. But these life benefits can also pay for a college education or even handle your mortgage.

It provides the foundation for a tax-advantaged or even tax-free retirement—something I’m very passionate about—almost as much as not risking any of my retirement money. I don’t want to risk yours, either.

So many people come to me who are approaching retirement but constantly worrying about whether they’re going to have enough money to last them in their golden years.

When they learn about Index Universal Life insurance, they find a safe vehicle that won’t lose any money for them. Even better, with proper planning and execution, the IUL policy can give them the level of financial independence in retirement they have always dreamed of!

What the IUL Can Do For Families...

- Can be a planned, not forced, retirement account.

- Protects against market risk by giving you market-like returns without the loss.

- Protects against tax risk and provides tax free benefits.

- Protects against premature death with a “self-completing” account.

- Protects your policy from creditors because life insurance is not considered in assets filings and in college funding requirements.

- Offers you living benefits that offsets life “happenings” and emergencies.

- Allows you to make money while you are using it at the same time.

- It is a “collateral-able asset,” which means that banks will make easy and favorable loans against the account.

- It offers liquidity, use and control with income tax-free funds available with a phone call. (Read the free chapter I offer you on this site to find out what that means!)

BIO:

Jeffrey Kiesel maintains an association with the National Ethics Bureau as well as continuing his 57-year membership with Boy Scouts of America. He also has held a certification of Lay Speaking in the United Methodist Church, & currently is an ordained Ruling Elder in the Presbyterian Church in America.

Jeffrey continues his interest & advocacy for seniors as well as teaching, as he serves his church in teaching Bible study groups and Sunday School, for both children and adults, along with his church choir membership and volunteer help with small home repairs for senior members.

100% Free Consultation

Financial, retirement and insurance planning all begins with a simple conversation.

Retirement Planning

It's never to late or too early to start. The important thing is to Start Today.

I’m interested in finding out about you and what you need for your money.

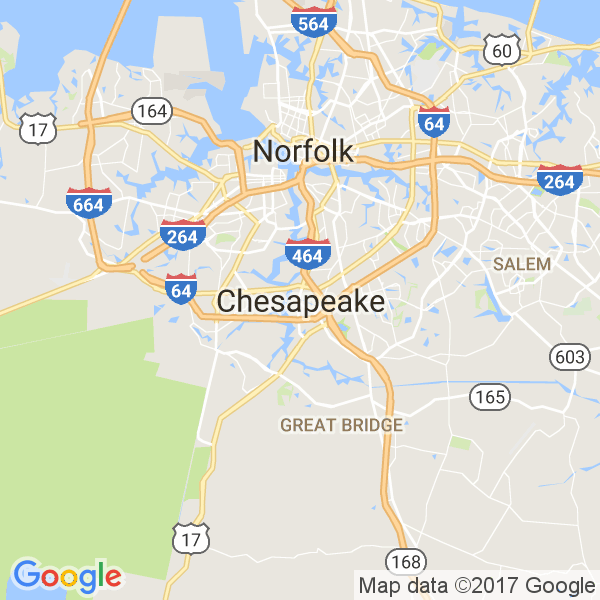

Serving the Philadelphia Region, The Greater

Mid-Atlantic States and Florida

Start Your Free Consultation

I look forward to meeting you.

2021 Solid Rock Retirement

O: (610) 827-0130

CUSTOM JAVASCRIPT / HTML

CUSTOM JAVASCRIPT / HTML